Hourly wage calculator by state

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The state tax year is also 12 months but it differs from state to state.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Need help calculating paychecks.

. See Why 40000 Organizations Trust Paycor. Next select the Filing Status drop down. See Why 40000 Organizations Trust Paycor.

These figures are pre-tax and. Multiply the hourly wage by the number of hours worked per week. See where that hard-earned money goes - Federal Income Tax Social Security and.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. For example if an employee earns 1500.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad The Best HR Payroll Partner For Medium and Small Businesses. First enter your Gross Salary amount where shown.

For instance the District of. The annual salary in our case is 50000 and we work 40 hours per week. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Our 2022 GS Pay. 50000 per year 52. California government employees who withhold federal income tax from wages.

For example if an employee makes 25 per hour and. About the United States Salary Comparison Calculator 202223. How to calculate Federal Tax based on your Hourly Income.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. However states may have their own minimum wage rates that override the federal rate as long as it is higher. For this purpose lets assume some numbers.

Washington state does not impose a state income tax. Using the United States Tax Calculator is fairly simple. Take A Guided Tour Today.

Federal Salary Paycheck Calculator. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. ICalculator provides the most comprehensive free online US salary comparison calculator with supporting detailed.

Hourly Paycheck and Payroll Calculator. Ad The Best HR Payroll Partner For Medium and Small Businesses. The federal minimum wage rate is 725 an hour.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Then multiply that number by the total number of weeks in a year 52. Some states follow the federal tax.

If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720. Welcome to the FederalPay GS Pay Calculator. This federal hourly paycheck.

Annual salary to hourly wage. 686 form to reflect the redesign. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information.

However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work. How to calculate annual income. The State Controllers Office has updated the Employee Action Request STD.

Using the United States Tax Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. A yearly salary of 45 000 is.

Take A Guided Tour Today. Based upon the information that you provided our calculator. If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720.

Chart The Living Wage Gap Statista

Salary Breakup Calculator Excel 2019 Salary Structure Calculator Breakup Salary Excel

Paycheck Calculator Take Home Pay Calculator

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Life Planning Printables Spreadsheet Template

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Microsoft Word Templates Templates

According To Tax Foundation California Ranks 49 In Migration Of Personal Incomes Map Illinois State Map

How To Calculate Pay Using The State Formula Rate Mit Human Resources

The Hourly Income You Need To Afford Rent Around The U S Being A Landlord Income New Things To Learn

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Hourly Rate Calculator The Filmmaker S Production Bible

Real Hourly Wage Calculator To Calculate Work Hour Net Profit

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates

Hourly To Salary What Is My Annual Income

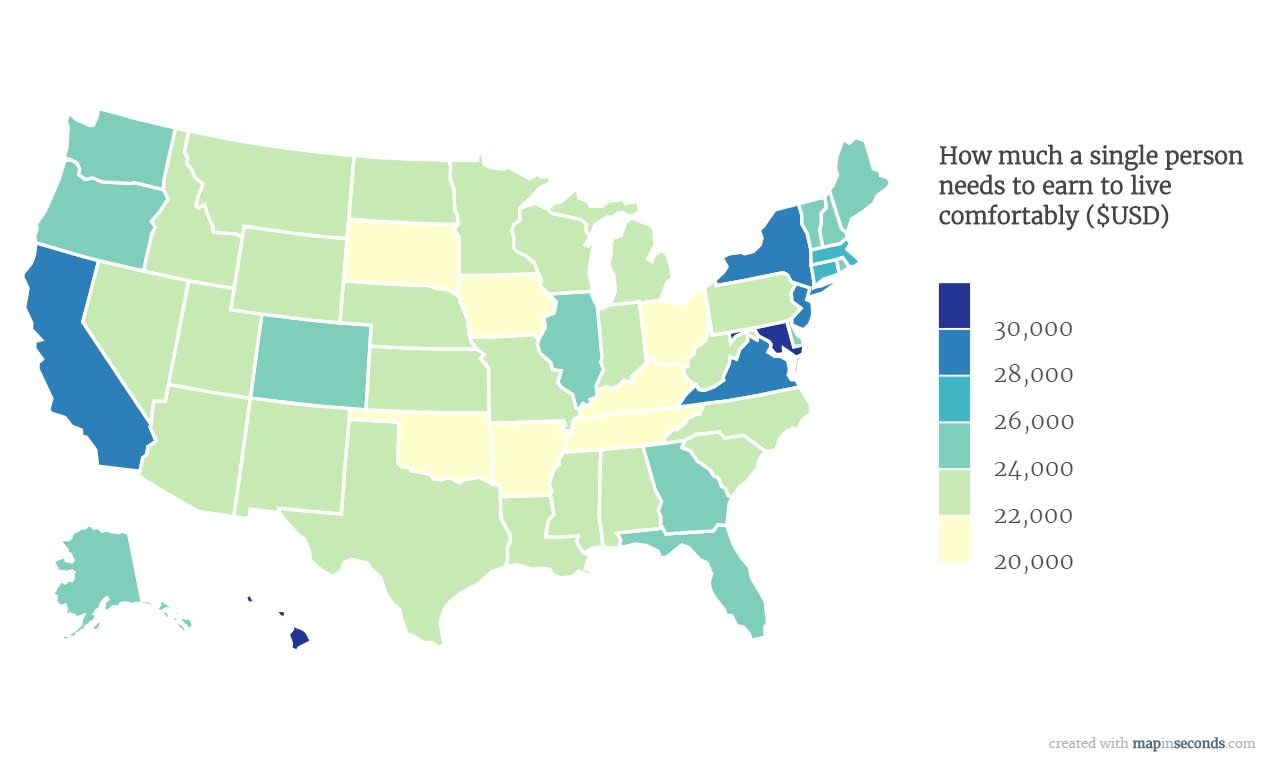

This Map Shows The Living Wage For A Single Person Across America

Hourly To Salary Calculator Convert Your Wages Indeed Com

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon